Investing in the perfect mix

Capital Markets is comprised of two groups: Public Market Equities and Fixed Income.

Public Market Equities are managed by both internal and external managers using a combination of traditional active, absolute return, and passive strategies. The Public Market Equities portfolio has an investment philosophy grounded in a risk-adjusted approach, which allows for the identification of the best opportunities in public equity and absolute return strategies.

The diversified Public Market Equities’ team leverages external partners to complement the internal public market value proposition. Our internal equity research platform provides ongoing market insights across the organization and across asset classes.

Fixed income is managed internally by an experienced team of investment professionals. This portfolio employs two main strategies: Corporate Credit and Global Sovereign Interest Rates.

Fast facts

-

Over $53.4B in equity investments

-

$45.0B in fixed income investments

What sets us apart?

-

Diversified portfolio of strategies

-

Capacity to sustain volatility

-

Strong co-investment capabilities

-

Sectoral expertise and deep analytical capabilities

Capital Markets

*Includes Public Market Equities and Fixed Income

[In C$ as at March 31, 2023]

Net assets under management (AUM)

Portfolio income

5-year annualized return

Capital Markets in action

Investing in Health

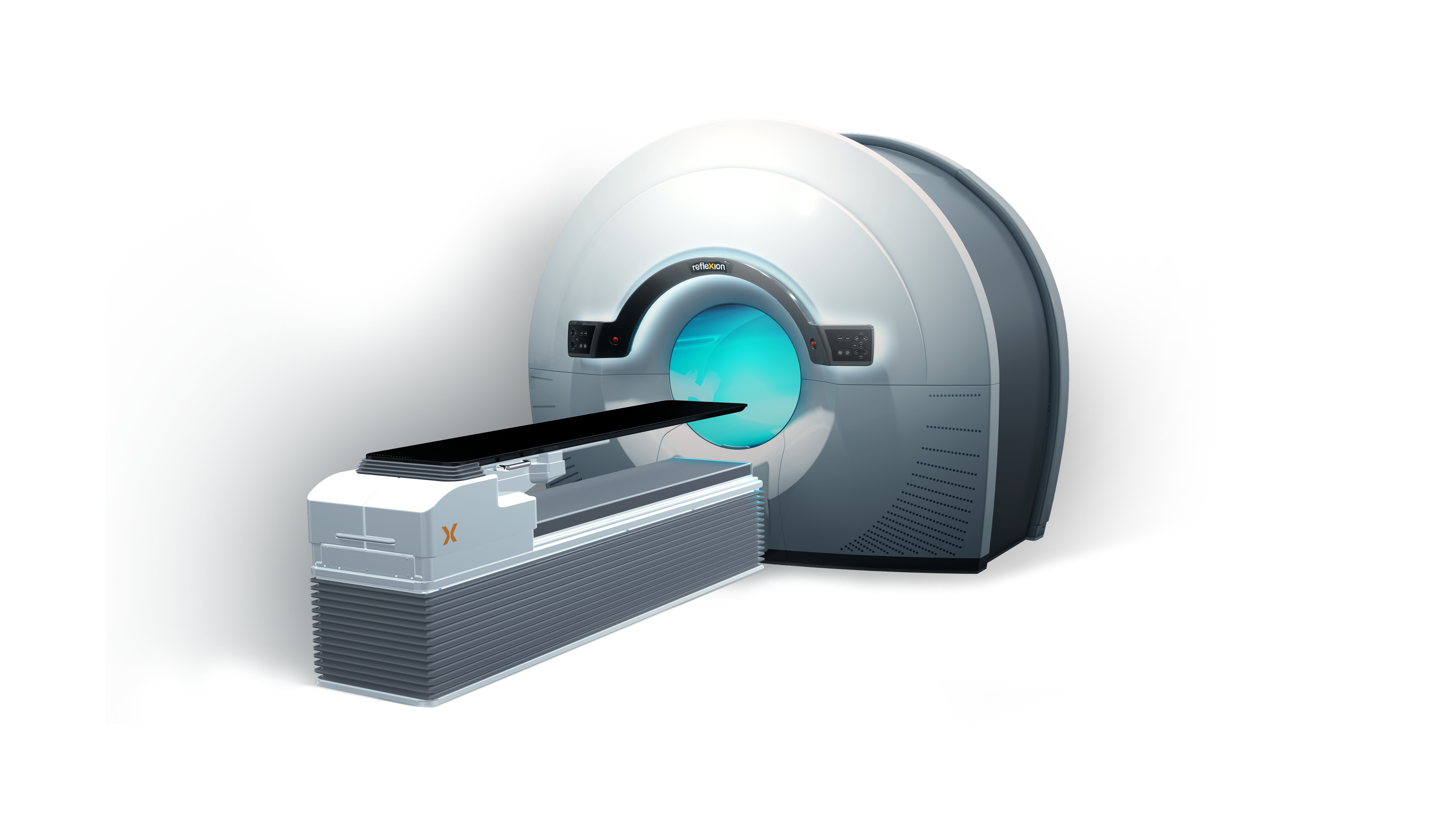

Company: RefleXion Medical

Strategy: Pre-IPO

Date: April 2020

A pioneer in biology-guided radiotherapy (BgRT), RefleXion Medical is a therapeutic oncology company focused on reshaping the approach to traditional cancer treatment. We identified RefleXion’s strong value proposition, leveraging internal expertise within Capital Markets—specifically the Fundamental Equity Research Platform. Capital Markets has built a long-term relationship with RefleXion in support of its next growth phase, as it progresses through clinical adoption and sales of its groundbreaking technology. RefleXion's Pre-IPO investment was made as part of a broader Capital Markets Alternatives' initiative to identify next-generation companies that seek to disrupt health care through innovation and transformative technologies.

Innovative event-driven strategies

Company: Yahoo

Headquarters: United States

Sector: Technology

Investment in company: 2014

We have been active in the Yahoo trade through its lifecycle. From our involvement in Alibaba's IPO, we implemented a sum-of-the-parts and a capital structure arbitrage, designed a merger and acquisition strategy to profit from Yahoo's sale of core assets to Verizon benefited from the US Tax Reform on a macro front. Our expertise in event-driven situations and our proficiency with multiple financial instruments allowed us to be agile and deploy a range of hedge fund strategies to profit from the unfolding of this situation while managing "directional risk".

Meet our team leader

Justin Nightingale

Managing Director and Head of Active Equities and Alpha Alternatives

Explore other asset classes

Want to discover how you can experience the edge? Join our team.